It won't guarantee a lower price, yet it might help. cheap car insurance. Some cars and truck insurance firms supply optional coverage that's nice to have, but might not be worth the cost.

Many insurance providers supply discount rates to clients that acquire several policies. You might have the ability to save money on your vehicle insurance policy by packing it with tenants insurance policy, homeowners insurance, life insurance coverage, bike insurance or other plan kinds. Some insurance business use a price cut if you participate in a protective driving program, either online or in-person - low cost.

You'll likewise obtain real-time notifies when modifications are made to your credit score report, such as new accounts as well as queries (vehicle). Checking your credit report very closely will offer you the details you require to develop and preserve a good credit rating.

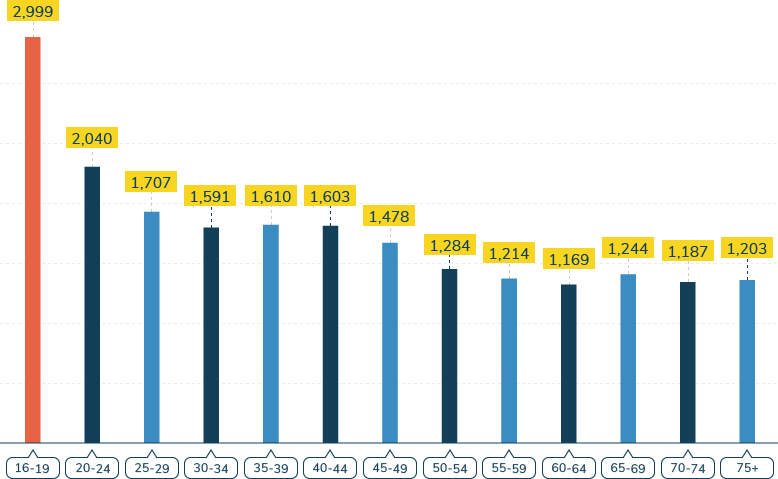

: Your age, Your driving experience as well as asserts document, Your credit history score, Your address, profession, or usage of the car, Your option of insurance business Right here are generally asked questions with examples of exactly how each of these elements impacts your insurance rate, and when you can expect to get cars and truck insurance policy discounts or get a lower price on vehicle insurance policy because of this.

The Facts About At What Age Do Car Insurance Rates Go Down? - Money ... Uncovered

For each and every year you do not have an insurance claim, you come closer to taking advantage of a claims-free discount rate, excellent motorist discount rate, or favored rates. To aid your insurance coverage rate go down when you've had an insurance claim, think about: Leveraging your insurance policy by combining your home as well as automobile insurance to get one more discount, Taking a greater insurance deductible to save cash (since making little claims is probably the last point you will intend to do if you are trying to clean up your insurance claims document)Take into consideration getting a usage-based insurance policy price cut What Regarding Beginning a Job or Marrying? Age is a significant aspect in the price of auto insurance coverage because a lot of various other points go hand-in-hand with age (insurance company).

You might move into a more secure neighborhood, which can save you money on insurance coverage. Some insurance policy business will lower the price of your insurance coverage or give a price cut if you are wed or have a family.

You don't have to stick with the same insurer to wait on your vehicle insurance policy to go down. Firms change from year to year, so you need to always ask inquiries and also look for the finest business for you. Does Automobile Insurance Coverage Go Down With a Good Credit Score Rating? Your cars and truck insurance coverage rate can go down significantly if your credit history enhances.

prices credit auto insurance car insurance

prices credit auto insurance car insurance

You can conserve a great deal of cash making use of a great credit rating for insurance coverage. automobile. If you have a poor credit history, shop around, due to the fact that you could find a business that puts less emphasis on credit rating in their rankings. If you are fixing or reconstructing credit rating, a firm less concentrated on the score might in fact save you money.

7 Simple Techniques For When Does Car Insurance Go Down

Will Usage-Based Program Make Cars And Truck Insurance Policy Decrease? Usage-based insurance policy is a rapid means for newer chauffeurs, more youthful drivers, or any kind of chauffeur that is a secure motorist to lower the cost of their cars and truck insurance coverage (cheap auto insurance). By using a device that tracks your driving routines, you might save substantial quantities of cash after a short time period.

Exactly how Do I Discover an Insurer with Lower Prices? Some points that will certainly make your cars and truck insurance expense decrease are not within your control (credit score). Yet others are. As an example, in a year when an insurance provider has actually more cases paid, your insurance prices might increase. These things are not in your specific control, except that you might be able to discover an insurance coverage business that has much better rates, also when others have higher ones.

Auto insurance policy premiums can be mystical at the most effective of times. If you move, acquire a new auto or simply age, prices can go up or down without a great deal of description. See what you might minimize car insurance, Quickly compare tailored prices to see just how much changing auto insurance could conserve you.

A young motorist is thought about by many insurance provider to be those who are under the age of twenty-five. A new vehicle driver can be any kind of age however would be classified as a new vehicle insurance coverage vehicle driver. Which primarily puts them in the very same classification as the young motorist. Concentrating on the "young" being inexperienced a lot more so than years.

What Age Does Car Insurance Go Down? - Ocean Finance Fundamentals Explained

It is required to have insurance policy in Canada. suvs. Insurance policy business understand that if a driver has actually never ever had insurance policy before then they are absolutely a new chauffeur.

Sadly, this experience is not identified by the Insurance provider. There may be some acknowledgment of this when it comes to the G1 as well as G2 licensing, yet nothing that is going to make a significant difference to the insurance policy rates. Past The Young as well as New Vehicle Driver Costs, It isn't just the young or brand-new vehicle drivers that are concerned concerning insurance coverage prices.

It is not unusual when renewal time comes around that some really see their rates go up - low-cost auto insurance. There can be numerous reasons why automobile insurance policy rates go up for a person.

An insurer may be realizing a loss as well as they will raise their prices to recoup this. This is not the mistake of the motorists that have experienced a price boost. If there does not seem to be a legitimate factor as to why the prices have actually enhanced it may be time for the guaranteed to do some insurance policy purchasing.

Teen Drivers - Nc Doi - The Facts

It must never be assumed that all insurance business are the exact same. Being Pro-Active in Insurance Premium Decreases, A basic reason that a vehicle driver may not be appreciating minimized costs is that they have not pursued them. It means learning more about your insurer as well as what motivations they provide.

car insurance cheaper cars auto insurance low cost

car insurance cheaper cars auto insurance low cost

Your insurance supplier may not use these to your premiums unless you make them aware that you receive them. An example is a senior that has actually gone years accident-free and also is still not seeing any kind of decrease in costs. automobile. It is important to come to be aggressive in obtaining your lorry insurance reduced.

A young motorist is taken into consideration by the majority of insurance coverage companies to be those who are under the age of twenty-five. A new motorist can be any kind of age however would certainly be classified as a first-time auto insurance policy vehicle driver.

It is obligatory to have insurance in Canada. Insurance companies understand that if a chauffeur has actually never ever had insurance policy before after that they are absolutely a new motorist.

Some Ideas on How Much Does It Cost To Add A Teenager To Car Insurance? You Need To Know

However, this experience is not identified by the Insurance firms. There might be some recognition of this when it comes to the G1 and also G2 licensing, but nothing that is going to make a significant difference to the insurance coverage rates. Beyond The Youthful and New Driver Premiums, It isn't just the young or new chauffeurs that are worried about insurance rates.

They would like to know when they are going to have the ability to enjoy costs decreases. It is not unusual when revival time occurs that some in fact see their prices rise. Why Do Prices Rise? There can be several reasons that car insurance policy rates increase for an individual. dui.

insurance low-cost auto insurance accident cheaper auto insurance

insurance low-cost auto insurance accident cheaper auto insurance

An insurance provider may be realizing a loss as well as they will increase their rates to recoup this. This is not the fault of the drivers who have actually experienced a price boost. If there does not appear to be a legitimate factor regarding why the rates have actually enhanced it may be time for the insured to do some insurance coverage purchasing.

It ought to never ever be assumed that all insurance provider coincide. Being Pro-Active in Insurance Policy Costs Decreases, A straightforward reason that a chauffeur Get more info might not be enjoying decreased premiums is that they have not pursued them - credit score. It means being familiar with your insurance provider and what incentives they offer.

All about What? Women Pay More Than Men For Auto Insurance? Yup.

Your insurance service provider may not apply these to your costs unless you make them mindful that you receive them. A good example is a senior that has gone lots of years accident-free as well as is still not seeing any reduction in premiums. It is necessary to come to be proactive in getting your car insurance policy reduced.

A young driver is taken into consideration by the majority of insurance provider to be those who are under the age of twenty-five. A brand-new vehicle driver can be any type of age however would certainly be classed as a new cars and truck insurance policy motorist. Which essentially puts them in the very same classification as the young driver. Concentrating on the "young" being inexperienced extra so than years.

The greater they regard the threats the higher the premiums are going to be. This suggests that newbie automobile insurance policy buyers do not have any kind of experience. It is mandatory to have insurance coverage in Canada. Insurance business recognize that if a vehicle driver has actually never ever had insurance coverage before after that they are absolutely a brand-new motorist - auto.

Unfortunately, this experience is not recognized by the Insurer. There may be some acknowledgment of this when it involves the G1 as well as G2 licensing, but nothing that is mosting likely to make a significant distinction to the insurance prices. Beyond The Young and New Vehicle Driver Premiums, It isn't just the young or new vehicle drivers that are concerned about insurance coverage prices.

Humana: Find The Right Health Insurance Plan - Sign Up For ... - An Overview

It is not unusual when renewal time comes around that some in fact see their rates go up - trucks. There can be a number of reasons why auto insurance coverage rates go up for an individual.

An insurer may be realizing a loss and they will boost their prices to recover this. This is not the mistake of the chauffeurs that have experienced a price rise. vehicle insurance. If there does not seem to be a legitimate factor as to why the prices have enhanced it might be time for the insured to do some insurance policy shopping.

auto insurance affordable business insurance car insurance

auto insurance affordable business insurance car insurance

cheap auto insurance low-cost auto insurance insurers

cheap auto insurance low-cost auto insurance insurers

It needs to never be assumed that all insurer coincide. Being Pro-Active in Insurance Premium Reductions, A simple reason that a driver may not be enjoying reduced premiums is that they have not gone after them. It means getting to understand your insurer and also what rewards they provide.

Your insurance policy service provider may not apply these to your premiums unless you make them conscious that you qualify for them. A fine example is a senior who has actually gone numerous years accident-free and is still not seeing any decrease in costs. It is necessary to come to be aggressive in getting your car insurance policy minimized.