affordable cheaper insurers cheaper auto insurance

affordable cheaper insurers cheaper auto insurance

Let's discuss just how deductibles function and also just how to choose the finest one for your budget as well as insurance coverage requirements. Simply placed, a deductible is the quantity of money you'll have to contribute in the direction of resolving an insurance coverage case.

insurers trucks vans vehicle insurance

insurers trucks vans vehicle insurance

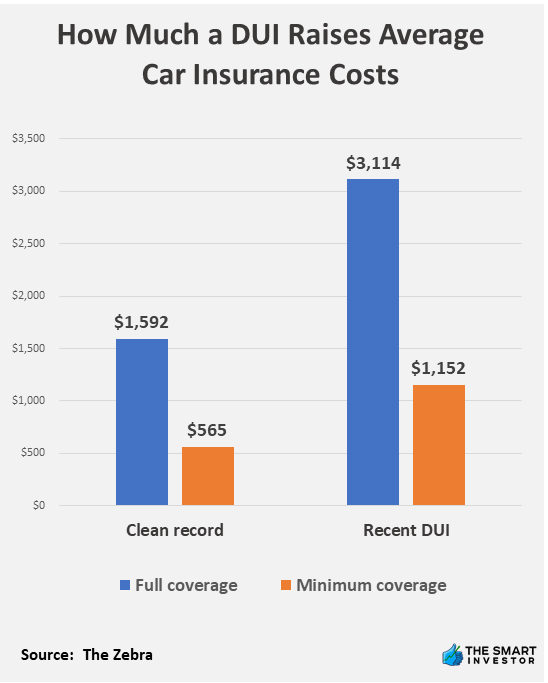

insurance cheaper car dui cheap

insurance cheaper car dui cheap

You would certainly have to cover half of the prices ($500) of that $1000 case. In a situation where the damages is approximated to be $500 or much less, the whole cost of repairs would certainly drop on you. Unusual, there are some exemptions where an insurance deductible is non-applicable. As an example, if another guaranteed vehicle driver is accountable for your damages and injuries, a deductible does not apply.

But for new car owners, the expectation might not be as glowing. The ordinary expense of a new vehicle is approximated to be $37,000, which leads to greater premiums. If you drive a new automobile as well as are associated with a significant accident, it can cause thousands in damage (allow alone the potential for injury) or complete the lorry (suvs).

For motorists with a high insurance deductible, the bulk of the fixing prices would drop on them. Stacking Insurance deductible, Prior to finalizing on the dotted line for your policy, you must validate how each scenario is dealt with. The reason is that numerous insurance policy bundles may have different deductibles, which are advancing. This is recognized as a "stacking deductible," as well as the ideal way to portray just how this functions is through an example: Allow's state you were driving an automobile with 3 other passengers as well as obtained hit by an uninsured chauffeur.

The Ultimate Guide To Is Car Insurance Tax Deductible? - H&r Block

Your deductible is set at $1000, and the agreement specifies it is used separately. This implies you would certainly need to contribute towards vehicle repairs and the medical bills of each as well as every traveler. Because of this, always make certain your deductible is packed in as several conditions as possible to stay clear of circumstances of this nature. credit score.

Understandably, the possibility of being included in an incident climbs the more time you invest behind the wheel - vans. The a lot more you drive, the lower the insurance deductible should be to help guarantee very Homepage little losses in the occasion of a mishap. Nevertheless, if you're only placing in a couple of thousand miles per year, choosing a greater insurance deductible can save you cash on your premium prices, and also this distinction may have the ability to help contribute if a crash does ever take place. cars.

While an insurance deductible may not use if you were not the driver liable, it does not always secure you in cases where the responsible motorist is underinsured or without insurance - cheap insurance. The decision you make on your deductible cost ought to be a matter of individual preference. The cost of an insurance policy costs scales with the insurance deductible, so finding the balance boils down to examining your budget plan and also dangers of having a mishap.

Q: Inquiry I have to select deductibles for my auto insurance coverage. What should I recognize prior to making my choice? A: Response An insurance deductible is the quantity you are in charge of paying when you have a protected thorough or accident loss. Think about it as a copay like you have with medical insurance. auto insurance. There are two kinds of auto coverage that have deductibles: collision and also extensive.

The Ultimate Guide To What Is A Deductible In Car Insurance? - J.d. Power

Many of the clients I've dealt with select an accident insurance deductible of $500, but available deductibles can vary from $100 to $1,000 depending on the insurance provider as well as where you live - affordable car insurance. Deductibles additionally vary with thorough coverage, which covers damage from things aside from accident, like theft, weather, and wild animals - cheaper car.

Remember, you choose the deductible quantity that works finest for you (affordable). Since a greater deductible methods that you will certainly need to pay more of a protected loss, a higher deductible generally implies you'll pay less in premium as well as vice versa. Your representative can take a seat with you and crunch the numbers then you can make an informed choice.

When producing a budget for your car insurance, there are two main prices that you need to maintain in mind your monthly premiums/rates and also your deductibles. Function of an Auto Insurance Policy Deductible, When it comes to obtaining auto insurance coverage, a deductible is paid when you file a case for your automobile in order to have your vehicle insurance cover the repair services.

Car insurance policy deductibles function regularly with the various kinds of automobile coverage you might acquire for your cars and truck. There are additionally some coverage kinds (like responsibility) that a deductible might not put on. credit. At the exact same time, you're also able to customize your deductible quantity to far better suit your automobile insurance budget plan.

The Greatest Guide To Car Insurance Deductibles: How Do They Work? - The Motley ...

There are a couple of important things you need to recognize prior to determining just how much you ought to establish your car insurance deductible quantity for. car insurance. We'll review what your deductibles can put on and also just how they can influence your automobile insurance coverage overall. Think about all that follows your personal overview to vehicle insurance policy deductibles. prices.

credit suvs credit score perks

credit suvs credit score perks

Normally, there's obligation insurance policy which most states need their drivers to lug in the event they create one more motorist physical damage or car damage. Car insurance coverage deductibles won't apply to harm that you triggered to one more motorist.

These in fact may be called for in some states. Individual injury assists cover medical expenditures for you as well as other travelers in your auto at the time of the accident. Without insurance vehicle driver coverage, as the name suggests, covers you should you be struck by a driver without cars and truck insurance coverage to cover the damages. auto.